Price Forecasting Models For Du Pontde Nemours Cta Pa Stock Louis Pasteur

Predicting the future price of a stock is a challenging task, but it is one that can be made easier by using a variety of price forecasting models. In this article, we will discuss various price forecasting models that can be used to predict the future price of Du Pontde Nemours Cta Pa Stock Louis Pasteur. We will also provide a detailed analysis of each model, along with its advantages and disadvantages.

4.9 out of 5

| Language | : | English |

| File size | : | 2286 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 56 pages |

| Lending | : | Enabled |

| Mass Market Paperback | : | 432 pages |

| Lexile measure | : | 1210L |

| Item Weight | : | 1.19 pounds |

| Dimensions | : | 6.14 x 0.63 x 9.21 inches |

| Hardcover | : | 258 pages |

Technical Analysis Models

Technical analysis models are based on the assumption that the past price movements of a stock can be used to predict its future price movements. These models use a variety of mathematical and statistical techniques to identify trends and patterns in the price data. Some of the most popular technical analysis models include:

- Moving averages

- Exponential moving averages

- Bollinger bands

- Relative strength index (RSI)

- Stochastic oscillator

Technical analysis models can be useful for identifying short-term trends in the price of a stock. However, they are not as reliable for predicting long-term price movements. This is because technical analysis models do not take into account the fundamental factors that can affect the price of a stock, such as the company's financial performance, the overall economy, and the political climate.

Fundamental Analysis Models

Fundamental analysis models are based on the assumption that the future price of a stock is determined by the company's financial performance and the overall economy. These models use a variety of financial data to assess the company's profitability, solvency, and growth potential. Some of the most popular fundamental analysis models include:

- Discounted cash flow (DCF) model

- Earnings per share (EPS) model

- Price-to-earnings (P/E) ratio

- Price-to-book (P/B) ratio

- Debt-to-equity (D/E) ratio

Fundamental analysis models can be useful for identifying long-term trends in the price of a stock. However, they are not as reliable for predicting short-term price movements. This is because fundamental analysis models do not take into account the technical factors that can affect the price of a stock, such as the supply and demand for the stock, the market sentiment, and the news headlines.

Econometric Models

Econometric models are based on the assumption that the future price of a stock is determined by a variety of economic factors, such as the inflation rate, the interest rate, and the GDP growth rate. These models use a variety of statistical techniques to estimate the relationship between the price of a stock and these economic factors. Some of the most popular econometric models include:

- Linear regression model

- Vector autoregression (VAR) model

- Structural equation model (SEM)

Econometric models can be useful for identifying the long-term relationship between the price of a stock and the overall economy. However, they are not as reliable for predicting short-term price movements. This is because econometric models do not take into account the technical and fundamental factors that can affect the price of a stock.

Machine Learning Models

Machine learning models are based on the assumption that the future price of a stock can be predicted by using a computer to learn from the past price data. These models use a variety of machine learning algorithms to identify patterns in the price data and to make predictions about future price movements. Some of the most popular machine learning models include:

- Support vector machines (SVM)

- Neural networks

- Decision trees

- Random forests

Machine learning models can be useful for identifying both short-term and long-term trends in the price of a stock. However, they are not as reliable as traditional price forecasting models, such as technical analysis models or fundamental analysis models. This is because machine learning models are still under development and they have not been tested as extensively as traditional price forecasting models.

There are a variety of price forecasting models that can be used to predict the future price of Du Pontde Nemours Cta Pa Stock Louis Pasteur. Each model has its own advantages and disadvantages, and the best model for a particular investment will depend on the individual investor's risk tolerance and investment goals. Technical analysis models are best suited for identifying short-term trends in the price of a stock, while fundamental analysis models are best suited for identifying long-term trends in the price of a stock. Econometric models are best suited for identifying the long-term relationship between the price of a stock and the overall economy, while machine learning models are best suited for identifying both short-term and long-term trends in the price of a stock. By using a variety of price forecasting models, investors can increase their chances of making profitable investment decisions.

4.9 out of 5

| Language | : | English |

| File size | : | 2286 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 56 pages |

| Lending | : | Enabled |

| Mass Market Paperback | : | 432 pages |

| Lexile measure | : | 1210L |

| Item Weight | : | 1.19 pounds |

| Dimensions | : | 6.14 x 0.63 x 9.21 inches |

| Hardcover | : | 258 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Chapter

Chapter Story

Story Reader

Reader Library

Library E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Bookmark

Bookmark Bibliography

Bibliography Foreword

Foreword Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Tome

Tome Classics

Classics Library card

Library card Narrative

Narrative Memoir

Memoir Encyclopedia

Encyclopedia Narrator

Narrator Character

Character Resolution

Resolution Card Catalog

Card Catalog Borrowing

Borrowing Stacks

Stacks Study

Study Research

Research Academic

Academic Reading Room

Reading Room Special Collections

Special Collections Interlibrary

Interlibrary Study Group

Study Group Thesis

Thesis Dissertation

Dissertation Storytelling

Storytelling Book Club

Book Club Theory

Theory Deborah Bouziden

Deborah Bouziden Tony Platt

Tony Platt Paris Anderson

Paris Anderson Rohit Bhargava

Rohit Bhargava R H Sin

R H Sin Die Kulinarischen Gaumenfreunde

Die Kulinarischen Gaumenfreunde Maureen Connors Santelli

Maureen Connors Santelli Jeff Swystun

Jeff Swystun Sarah Lundberg

Sarah Lundberg Jaime Lim

Jaime Lim Riley Edwards

Riley Edwards Robert W Valenti

Robert W Valenti Graham Seal

Graham Seal Kevin D Greene

Kevin D Greene Juan Villalba

Juan Villalba Zoya Schmuter

Zoya Schmuter Leyla Najma

Leyla Najma Twinkie Chan

Twinkie Chan Sarah Justina Eyerly

Sarah Justina Eyerly Phyllis Greene

Phyllis Greene

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Michael SimmonsUnveiling the Enchanting World of Little Baby Jesus Estate Walls Nhb Modern...

Michael SimmonsUnveiling the Enchanting World of Little Baby Jesus Estate Walls Nhb Modern...

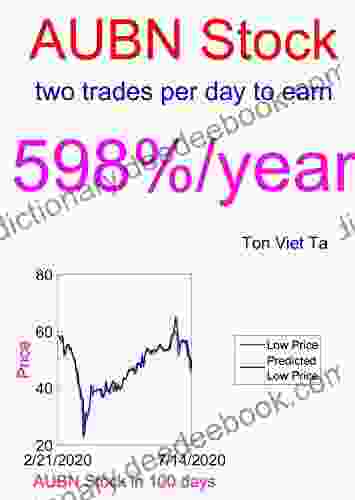

Ibrahim BlairUnveiling Price Forecasting Models for Auburn National Bancorporation Inc...

Ibrahim BlairUnveiling Price Forecasting Models for Auburn National Bancorporation Inc... Rick NelsonFollow ·18k

Rick NelsonFollow ·18k Mikhail BulgakovFollow ·14.8k

Mikhail BulgakovFollow ·14.8k Austin FordFollow ·16.6k

Austin FordFollow ·16.6k Fernando BellFollow ·9k

Fernando BellFollow ·9k Floyd PowellFollow ·16.7k

Floyd PowellFollow ·16.7k Junichiro TanizakiFollow ·12.1k

Junichiro TanizakiFollow ·12.1k Harold BlairFollow ·14.8k

Harold BlairFollow ·14.8k F. Scott FitzgeraldFollow ·4.1k

F. Scott FitzgeraldFollow ·4.1k

Jerome Powell

Jerome PowellBarbara Randle: More Crazy Quilting With Attitude -...

A Trailblazing Pioneer in...

Jan Mitchell

Jan MitchellLapax: A Dystopian Novel by Juan Villalba Explores the...

In the realm of dystopian literature, Juan...

Rodney Parker

Rodney ParkerOur Mr. Wrenn: The Romantic Adventures of a Gentle Man

Our Mr. Wrenn is a 1937 novel...

4.9 out of 5

| Language | : | English |

| File size | : | 2286 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 56 pages |

| Lending | : | Enabled |

| Mass Market Paperback | : | 432 pages |

| Lexile measure | : | 1210L |

| Item Weight | : | 1.19 pounds |

| Dimensions | : | 6.14 x 0.63 x 9.21 inches |

| Hardcover | : | 258 pages |